The company has taken significant steps by updating its vision and mission in the Company’s Long-Term Plan (RJPP) for 2025-2029. This update is part of its commitment to adapt to the increasingly dynamic business environment, including technological developments and the ever-changing market demands.

Dear Shareholders, The honorable Stakeholders,

To begin this report, on behalf of the Board of Directors, we express our gratitude to God Almighty for His blessings and grace that enabled the Company to successfully navigate 2024 with positive achievements. Throughout this challenging journey, the Company has remained steadfast in its commitment to delivering the best for the community, customers, and all stakeholders. Allow us to present the Company’s performance developments throughout 2024 as part of our efforts to build a strong foundation for a brighter future and sustainable growth, thereby creating value for all stakeholders.

Conditions of National Economic and Industry in 2024

Entering 2024, Indonesia’s national economy has shown positive growth despite global challenges. According to data from the Central Statistics Agency (BPS), Indonesia’s Gross Domestic Product (GDP) growth reached 5.03% in 2024. The main factors supporting this growth are increased household consumption, investment, and exports, particularly in the commodities sector. In addition, the recorded inflation stability of 1.57% has provided room for increased public purchasing power, which has a positive impact on the demand for infrastructure, including toll roads.

In the toll road industry context, significant progress was evident in ongoing projects and operations. As of the third quarter of 2024, the total length of operational toll roads in Indonesia exceeded 2,500 km, with projections for an additional 500 km by the end of the year. Revenue from the toll road sector also increased, driven by a surge in traffic volume, reflecting heightened mobility post-pandemic and the execution of major infrastructure projects that expanded the toll road network nationwide.

Strategic Direction and Policies

The Company has taken significant steps by updating its vision and mission as part of the Corporate Long-Term Plan (RJPP) 2025–2029. This update reflects the Company’s commitment to adapting to an increasingly dynamic business environment, including technological advancements and evolving market demands. With a solid foundation of experience and an extensive network, the Company remains committed to innovation and enhancing its services. This commitment is crucial for maintaining its position as the leader in Indonesia’s toll road industry. However, future success heavily relies on the Company’s ability to adapt its business strategies effectively, respond to market dynamics, and comply with continuously evolving regulations. In this context, the Company recognizes that flexibility and responsiveness are essential to remaining relevant and competitive in an increasingly challenging industry.

Based on the newly formulated vision and mission, the Company has identified strategic objectives as the foundation for its Corporate Long-Term Plan (RJPP) for 2025–2029. These objectives are designed to enhance the performance of the existing portfolio while better engaging with and understanding customers. The identified strategic objectives are as follows:

- Maximizing technology as an enabler to deliver innovative toll road infrastructure services aligned with user needs. This involves utilizing technology to improve operational efficiency, enhance user experience, and develop new solutions to meet evolving market demands. Proactive customer engagement is essential to drive service improvements, identify new service types, create opportunities for new revenue streams, and enhance overall customer satisfaction.

- Enhancing the performance of the existing portfolio while exploring opportunities for broader market expansion. This includes improving the quality and efficiency of toll road infrastructure owned, operated, or under construction. Additionally, it involves identifying and exploring opportunities to expand market coverage, whether through the acquisition of existing assets (brownfield), minority investments in new projects, or the provision of partial Operation & Preservation services in toll road segments abroad.

- Driving innovation through collaboration with stakeholders within the toll road ecosystem while developing core capabilities. Innovation efforts go beyond merely creating new technologies. They also collaborate with various stakeholders, including governments, communities, and other companies within the ecosystem, to develop and implement innovative solutions.

- Expanding the implementation of Electronic Toll Collection (ETC) technology solutions across Indonesia. This entails accelerating the adoption of automated toll payment systems (ETC) throughout the Indonesian toll road network. The process involves collaboration with external parties, including strategic partners, technology developers, other toll road operators, and customers. This collaboration aims to facilitate broader adoption of the technology, improve toll payment efficiency, and reduce traffic congestion at toll gates.

- Setting targets and implementing sustainable initiatives contributing to national decarbonization goals. This involves establishing targets and implementing sustainable initiatives to reduce carbon emissions in alignment with national objectives. By doing so, the Company aims to strengthen its reputation as an environmentally conscious and sustainable organization, serving as a differentiator and building trust among the public and investors.

The Company has outlined its strategies to support the achievement of the above strategic objectives through 3 (three) main strategies directly related to its business aspects, including Concession Business, Toll Road Support Business, and Prospective Business, as well as 6 (six) other supporting strategies as follows:

- Business Strategies

-

Concession Business

Optimizing the performance of the toll road concession portfolio through standardizing Operation & Preservation costs and managing the portfolio of all the Company’s concession assets. -

Toll Road Supporting Business

Expanding the market by leveraging the unique selling points of Operation and Preservation service providers. -

Prospective Business

Increasing the utilization of non-toll assets to boost non-toll revenue and enhance the Jasa Marga brand image.

-

Concession Business

- Functional Strategies

-

Innovation & Customer Experience

Developing and commercializing customer-centric products and services through innovation management and collaboration. -

Business Development

Transitioning to a brownfield investment business model and exploring opportunities for international market expansion. -

Technology

Enhancing technological capacity and infrastructure to support data-driven decision-making. -

Financial

Improving cost efficiency through alternative funding sources and enhancing portfolio management via integrated asset management. -

Organization and Human Resources (HR)

Undertaking organizational restructuring, upskilling the workforce, and establishing shared services to support the Company’s business plans. -

Environmental, Social, and Governance (ESG)

Promoting the adoption of green initiative use cases in core operational activities and exploring opportunities to issue green financing instruments.

-

Innovation & Customer Experience

The Role of the Board of Directors in Formulating Strategic Direction and Policies

In formulating the company’s strategic direction and policies, the Board of Directors is actively involved in conducting an in-depth analysis of market dynamics and applicable regulations, ensuring that the strategies developed are relevant and adaptable to the constantly changing conditions. This is crucial to ensure that the company is capable of surviving the challenges and capitalizing on the opportunities in the market. With a proactive approach, the Board of Directors consistently evaluates the company’s performance and makes adjustments to existing policies, enabling the company to move swiftly and efficiently.

In addition to formulating overall strategies, the Board of Directors also focuses on direction and strategic policies for each business unit. This process includes setting clear business targets, and measurable growth plans, and acquiring essential resources such as technology and infrastructure needed to achieve those goals. Human resources are a key focus, with the Board of Directors ensuring the company has a competent workforce ready to face challenges in the toll road industry. Furthermore, risk management is also a critical concern, with the Board of Directors implementing preventive and responsive measures to mitigate potential risks that could disrupt the Company’s operations.

In formulating these strategies, the Board of Directors always coordinates with the Board of Commissioners to receive guidance, input, and constructive advice. This collaboration ensures that the policies adopted are not only based on internal viewpoints but also considering a broader external perspective. The Board of Directors is also responsible for ensuring that the organizational framework operates effectively, with targeted policies and procedures, and prudent risk management infrastructure.

The Process Conducted by the Board of Directors to Ensure Strategy Implementation

The Company adopts a systematic approach to ensure the implementation of its strategy by aligning the Long-Term Company Plan (RJPP) and the Annual Corporate Work Plan and Budget (RKAP). This process begins with setting clear strategic objectives in the RJPP, which are then integrated into the RKAP. In this way, all business lines and support units share a common understanding of the priorities and targets to be achieved. This alignment provides clear direction for each unit and ensures that resources are allocated efficiently to support those objectives. The Board of Directors is committed to overseeing each step in this process, ensuring that all plans are aligned and support one another.

Effective communication is a key element in the strategy implementation process. The Board of Directors regularly holds performance evaluation meetings with business lines, support units, and all subsidiaries. In these meetings, the Board of Directors communicates policies and guidance and listens to feedback from each unit regarding the challenges faced in implementing the strategy. Through open and transparent communication, each unit can report on progress and any issues that may hinder the achievement of targets, allowing for swift corrective actions. These evaluation meetings serve as an important forum to strengthen synergy between units, ensuring that all elements within the Company are working toward the same goals.

To ensure effective strategy implementation, the Board of Directors actively monitors the execution of the strategy through periodic reviews. In each meeting, the Board of Directors discusses key performance indicators, including financial performance, business development, operational issues, business risks, digital transformation, and employee performance. These reviews focus on achieving numerical targets and consider the context behind each indicator, ensuring that decisions are relevant and aligned with market dynamics and applicable regulations. Providing constructive feedback is also part of this process, where the Board of Directors offers necessary guidance for further improvements and development.

Comparison Between Achievements and Targets

One of the benchmarks for the success of the Company can be seen from the performance achievements in 2024, compared to the targets set in the 2024 Company Work Plan and Budget (RKAP). In 2024, the Company demonstrated excellent performance, with various key indicators showing satisfactory results. Considering the fluctuating market and economic conditions, the Board of Directors ensured that all strategies and policies adopted were focused on achieving realistic and measurable targets. These achievements reflect financial performance and the Company’s ability to manage and implement the various formulated strategic initiatives.

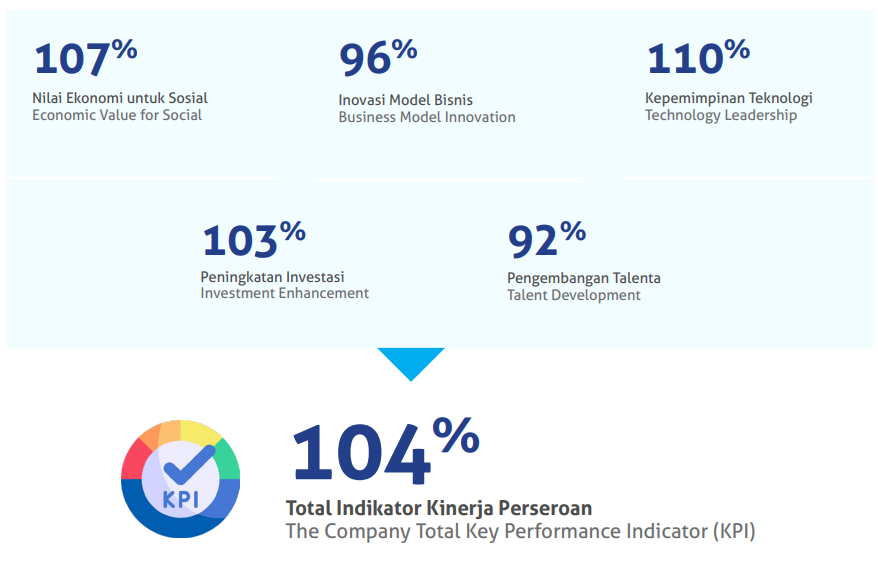

Achievement of the Five Strategic Perspectives of Company Performance Indicators in 2024

Support from the strengthening of the national economy and the increasing activities of the public, including the return to normal mobility post-pandemic, contributed significantly to the Company’s performance in 2024. Through proactive measures, such as optimizing services and the continuous development of infrastructure, the Company could meet and even exceed the targets set in the RKAP. The increase in traffic volume and toll revenue played crucial roles in maintaining the Company’s long-term financial health. Furthermore, the Company also emphasized sustainability in its operations, which contributed to achieving targets and positive impacts on society.

The Company’s key performance is measured through five strategic perspectives: (i) Economic and Social Value for Indonesia, (ii) Business Model Innovation, (iii) Technological Leadership, (iv) Investment Growth, and (v) Talent Development. From these perspectives, the total corporate Key Performance Indicator (KPI) for 2024 was achieved at 103.7%, indicating an achievement above plan by 3.7%. This result shows that the Company is focused on financial aspects and committed to creating broader added value for stakeholders.

Company Performance Analysis

The transaction traffic volume in 2024 was recorded at 1,301.8 million transactions. The company also adjusted tariffs this year on nine toll roads, namely Kunciran-Cengkareng, Cinere-Serpong, Jakarta-Cikampek, Jakarta-Cikampek Elevated, Bali-Mandara, Gempol-Pandaan, Surabaya-Mojokerto, Cawang-Tomang-Pluit, and Jakarta-Tangerang. These adjustments led to an increase in toll revenue performance of 23.2%, to IDR 17.2 trillion and an increase in EBITDA of 27.3%, to IDR 12.6 trillion.

Challenges, Obstacles, and Solutions

In addition to the economic challenges both globally and nationally, the Company also faces some challenges influenced by internal and external factors as follows:

- Toll Road Concession Business Line

In the toll road concession business line, the Company faces various challenges, including land acquisition and licensing issues, which often require complex and time-consuming processes. Slow land acquisition can delay the construction of planned toll road projects, affecting completion schedules and revenue potential. Additionally, unexpected regulatory changes and government policies may also become obstacles in toll road concession operations.

To address these challenges, the Company has implemented a collaborative approach with the government and other stakeholders. The Company is actively involved in dialogue with local communities to gain support for the land acquisition process. Furthermore, the Company optimizes the use of technology to expedite the licensing process and ensure compliance with applicable regulations. - Operating Business Line

The operating business line also faces challenges, particularly related to infrastructure maintenance and service quality. Increased traffic volume can lead to a decline in toll road quality if not balanced with adequate maintenance. Furthermore, extreme weather conditions and environmental factors can affect toll road infrastructure, leading to increasing operational costs and potential service disruptions for users.

To overcome these problems, the Company has implemented a technology-based maintenance management system that enables real-time monitoring of infrastructure conditions. Through the use of sensors and management software, the Company can detect damage early and perform preventive maintenance before problems escalate. Additionally, the Company focuses on employee training regarding service standards and safety to ensure optimal and safe service for road users. - Prospective Business Line

In the prospective business line, the main challenge is identifying and developing new projects that align with market needs and infrastructure development trends. Limited funds and high investment risks present barriers to developing new projects, particularly amid intense competition from other companies within the same industry.

The Company seeks to overcome this challenge by conducting thorough feasibility studies for each project to ensure that the investments have adequate profit potential. Furthermore, the Company explores collaboration opportunities with private investors and financial institutions to secure the necessary funding. - Financial Sector

In financial sector, the main challenge the Company faces is cash flow management and financing for infrastructure projects requiring substantial investments. Economic uncertainty and fluctuating interest rates can affect loan costs and the available cash flow for operations and investments.

To address this challenge, the Company has strengthened its financial management strategy by diversifying funding sources, including bond issuance and partnerships with financial institutions. The Company also implements prudent financial risk management and optimizes cash flow through more effective budget planning. - Human Resources and General Affairs

In the human resources and general affairs sector, the challenges include the need to attract and retain high-quality talent amidst increasing industry competition. Additionally, the development of employee skills and competencies is crucial to support innovation and digital transformation within the Company.

The Company has formulated various strategic steps to address these constraints, including continuous development trainings and programs for the employees. Additionally, the Company actively builds partnerships with educational institutions to develop internship and recruitment programs that bridge industry needs with available talent.

Strengthening the Foundation for Sustainable Growth

The company is committed to strengthening the foundation for sustainable growth by implementing innovative technologies that drive operational efficiency while meeting the Minimum Service Standards (MSS). In the rapidly evolving digital era, the company invests resources to integrate advanced information technology systems into toll road operations. The use of technologies such as smart traffic management systems and electronic payments not only improves the speed and convenience of services for users but also helps in reducing operational costs. By ensuring that every innovation remains aligned with the MSS, the company strives to deliver the best experience to customers without compromising service quality.

In addition to technological advancements, the company adopts effective risk management across its entire business value chain. By proactively identifying and mitigating risks, the company can maintain operational continuity and prevent potential disruptions that could hinder the achievement of strategic targets. This approach includes implementing a comprehensive risk management framework, which covers financial, operational, and reputational risk analysis. As a result, the company not only protects its existing assets and investments but also creates a stable and conducive environment for long-term growth.

To maintain financial health, the company has undertaken several strategic corporate actions, including optimizing the investment portfolio and seeking alternative funding sources. The implementation of digital learning also remains a key focus, with the goal of enhancing human capital capacity through technology-based employee training and development programs. With these initiatives, the company is committed to achieving short-term performance and creating sustainable value that positively impacts all stakeholders.

Business Prospects

Welcoming 2025, external challenges, especially from a macroeconomic perspective, will increase. However, the Company remains optimistic about the national economic growth performance target which is predicted to reach 5.2% in the 2025 State Revenue and Expenditure Budget (APBN). The government projected to maintain the inflation at around 2.5% in order to uphold people’s purchasing power. This is expected to have a positive impact on the Company’s traffic volume and income.

The government has launched 17 new priority work programs aimed to support stability within the toll road industry. Additionally, the government continues to support the completion of toll road sections currently under development. Beyond this, long-term economic improvement by the government serves as a key indicator to foster regional growth and create opportunities for enhancing the mobility of people, goods, and services.

To support these positive business prospects, the Company is committed to continuously innovating and implementing the latest technology in its operations. Digitalization efforts that have already begun, such as more efficient toll payment systems and the use of big data for traffic analysis, are expected to enhance efficiency and provide a better experience for road users. By leveraging the vast market potential and keeping up with technological advancements, the Company will not only be able to face existing challenges but also be prepared to seize new opportunities that arise along with the economic growth and sustainable infrastructure development in Indonesia.

Implementation of Corporate Governance

The company demonstrates a strong commitment to Good Corporate Governance (GCG) by adhering to principles of ethical behavior, accountability, transparency, and sustainability. The application of good GCG serves as the foundation for the company in conducting responsible and sustainable business operations. In every operational step, the company prioritizes high ethical values, building trust among stakeholders, including investors, customers, and the community. Through this commitment, the company strives to create a professional work environment, comply with all applicable regulations, and support the achievement of the company’s long-term goals.

To enhance the quality and scope of GCG implementation, the company has carried out various initiatives and activities. One key initiative is regular training focused on anti-corruption, aimed at raising employee awareness of the importance of integrity and good governance in every activity. In addition, the company ensures the effective implementation of a whistleblowing system (WBS), which provides a safe channel for employees to report any suspected violations or misconduct without fear of retaliation. This initiative enhances transparency and fosters a responsive organizational culture to ethical and compliance issues.

The GCG assessment is conducted annually to evaluate how well GCG is implemented in the company. This process involves a comprehensive review of the practices that have been applied, with a score of xx indicating a good result. Through this assessment, the company can identify areas for improvement and ensure that all governance practices are consistently aligned with established standards.

Assessment of the Performance of Committees Under the Board of Directors and the Basis for Evaluation

In conducting functions and responsibilities, the Board of Directors is assisted by several committees with crucial roles, including the Risk Management Committee and the Information Technology Steering Committee. These committees have specific duties designed to strengthen decision-making and ensure that the company operates efficiently and comply with established standards. The Risk Management Committee focuses on identifying, assessing, and mitigating risks that may impact the company’s performance, while the Information Technology Steering Committee is responsible for ensuring that the use of information technology supports the company’s strategic and operational objectives.

Throughout 2024, both committees have successfully performed their duties, demonstrating a strong commitment to risk management and technological development. In conducting their functions, these committees not only adhered to the established guidelines and procedures but also provided valuable input to the Board of Directors on critical issues that needed attention. Through regular meetings, the committees were able to discuss the latest developments in risk management and technology and adjust strategies as necessary to respond to changes in the fast-paced and dynamic business environment.

The Board of Directors periodically evaluates the performance of the committees based on the established guidelines and procedures to ensure that each committee’s work program aligns with current economic conditions, business developments, and applicable regulations. This evaluation is conducted through a systematic assessment mechanism, including performance analysis, meeting effectiveness, and the contribution made to strategic decision-making. In this way, the Board of Directors ensures that all committees are operating optimally and contributing to the achievement of the company’s goals.

Changes in the Composition of the Board of Directors

In 2024, there were no changes in the composition of the Board of Directors. Therefore, the composition of the Company’s Board of Directors as of the date of this report is as follows:

| Position | Name |

|---|---|

| President Director | Subakti Syukur |

| Director of Business | Reza Febriano |

| Director of Human Capital and Transformation | Bagus Cahya Arinta B. |

| Director of Operations | Fitri Wiyanti |

| Director of Business Development | Mohamad Agus Setiawan |

| Director of Finance and Risk Management | Pramitha Wulanjani |

Appreciation

On behalf of the Board of Directors, we would like to express our appreciation to all employees of the Company for their dedication, hard work, and exceptional commitment in carrying out their duties and responsibilities. The achievements made this year are the result of solid collaboration and synergy among all units within the Company. We also extend our gratitude to all stakeholders, including customers, partners, and the government, for their continued support and trust in the Company. The Company’s commitment to prioritizing quality service and innovation in toll road infrastructure development is part of a collective effort to build a better future for Indonesia.

In conclusion, we invite all stakeholders to continue to support and uphold the strategic steps set out in the Company’s Long-Term Plan (RJPP) and the Company’s Work Plan and Budget (RKAP). Challenges will persist in the future, but with a strong foundation and a commitment to innovation, we are confident that the Company will continue to grow and make significant contributions to infrastructure development in Indonesia. Let us embrace the future with optimism, committed to achieving sustainable success and providing added value to the entire society.

Jakarta, April 15, 2025

On Behalf of the Board of Directors